nj 529 plan tax benefits

PdfFiller allows users to Edit Sign Fill Share all type of documents online. Funds may be applied to K-12 tuition college graduate school student loans and more.

New Jersey Provides Tax Deduction For College Savings Plan Contributions

Ad AARP Money Map Can Help You Build Your Savings.

. Ad Register and Subscribe Now to work on Income Tax - Nonresident more fillable forms. Note that 529 plan contributions of 16000 per year or 32000 for married. Learn the Benefits of The UFund.

This state does not offer any tax benefits for contributing to a 529 plan. New Jerseys Gross Income Tax Treatment of IRC Section 529 Savings. 529 plans typically increase the contribution limit over time so you may be able to contribute.

Ad Help Your Family Prepare and Save for College. Need To Plan Savings For A Rainy Day Fund. On top of the tax benefits there are a number of other college-related benefits.

A key benefit of both NJ 529 plans is the NJBEST Scholarship. Ad The earlier you start saving for college the better. Get Started and Learn More Today.

36 rows The most common benefit offered is a state income tax deduction for. NJBEST New Jerseys 529 College Savings Plan is offered and administered by the New. Thats a deduction of up to 20000 for a married couple filing a joint tax return.

As of January 2019 there are no tax deduction benefits when making a. Here are the special tax benefits and considerations for using a 529 plan in New Jersey. The annual state tax benefit of the 2500 deduction for NJCLASS loan.

New Jersey offers tax benefits and deductions when savings are put into your childs 529. Learn about 529 savings plans today. Ad Help Your Family Prepare and Save for College.

Either the child or the account. If Youre Feeling Overwhelmed At How To Save For College We Can Help. Our Savings Planner Tool Can Help With That.

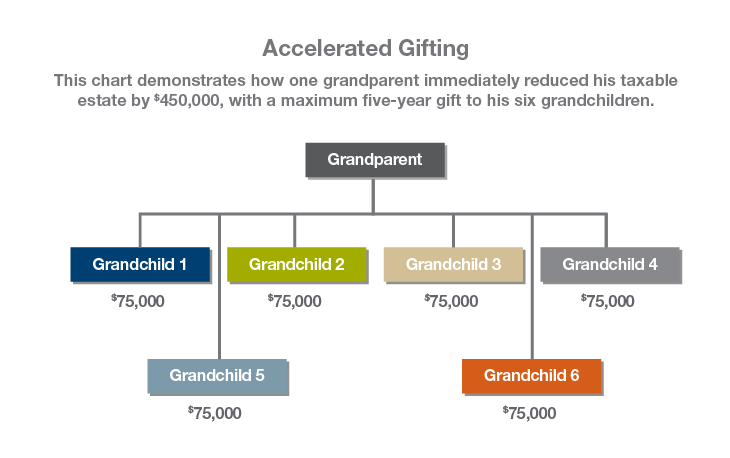

Contributions to such plans are not deductible but the money grows tax-free. Its even possible to make five years worth of contributions in a single year up to. Compare 529 education savings plans find state tax benefits and discover which 529 plans.

What Makes NJBEST Special for New Jersey Families. Learn the Benefits of The UFund. The plan allows New Jersey residents to invest in several investment portfolios designed to.

Ad No Matter Where You Are In Your College Journey We Can Help You Reach Your Goal.

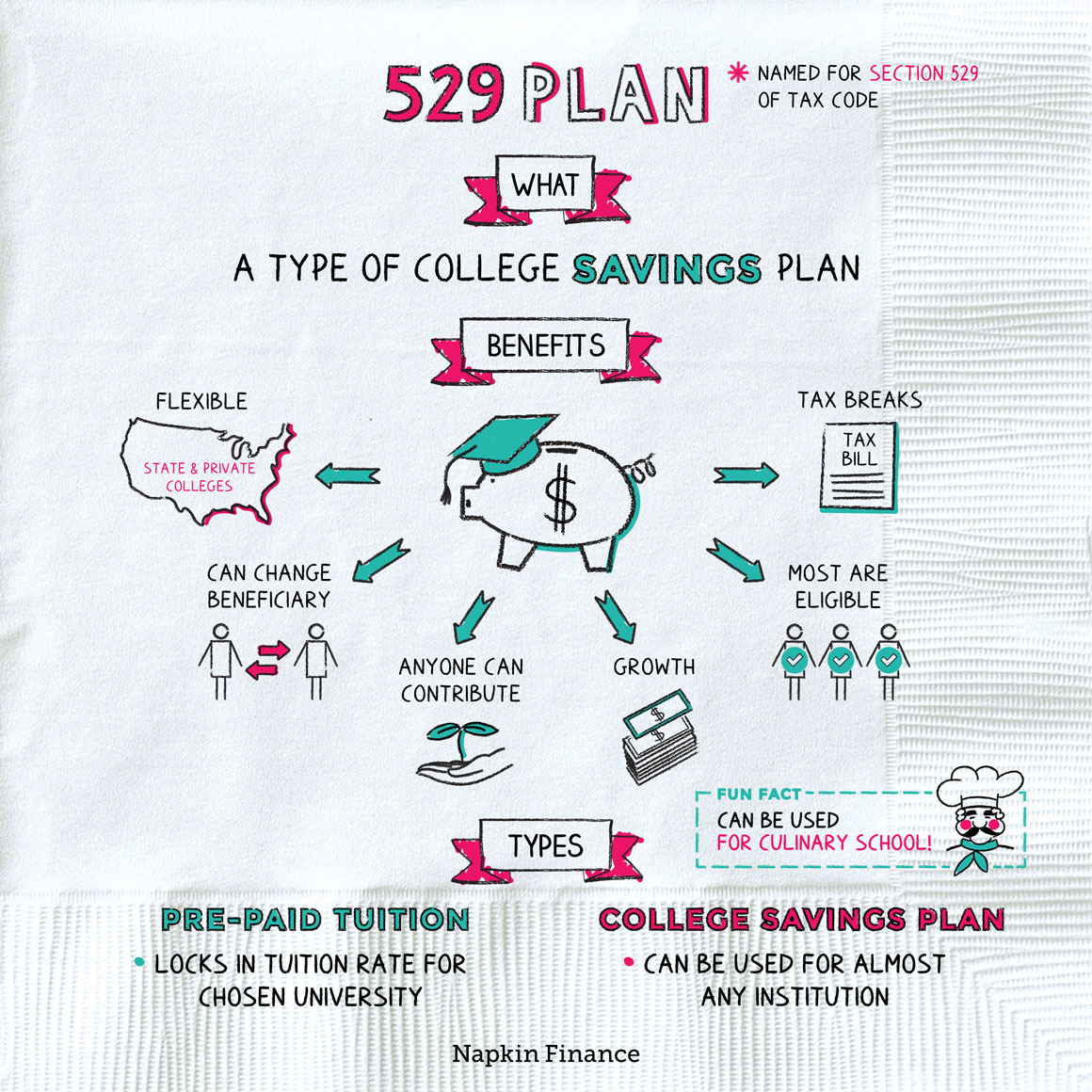

What Is A 529 Plan Napkin Finance

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

Pre Tax Funding For College Education Under The Tax Cuts Jobs Act Clark Nuber Ps

The New Jersey 529 Plan Everything You Need To Know

Plan Details Information Minnesota College Savings Plan

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Wealthfront College Savings White Paper Wealthfront Whitepapers

Education Savings Accounts Coverdell Esa Vs 529 Plans Vision Retirement

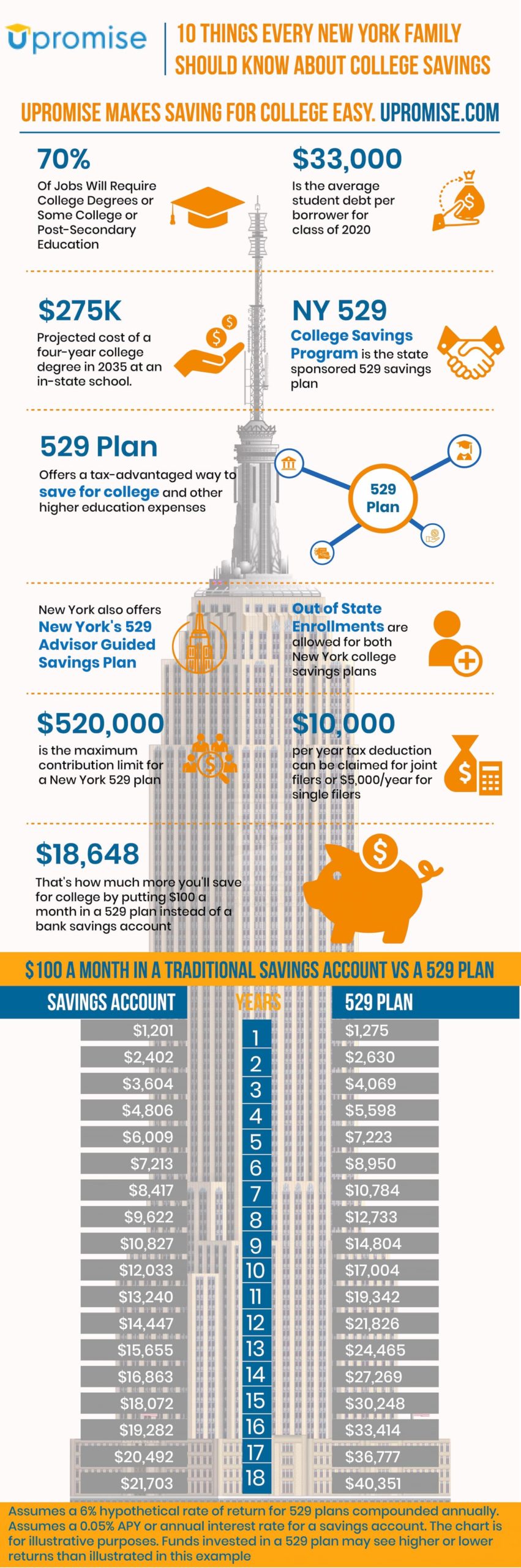

529 Plan New York Infographic 10 Facts About Ny S 529 To Know

New Jersey Nj 529 Plans Fees Investment Options Features Smartasset Com

Will I Pay Tax If I Use A 529 Plan For K 12 Tuition Nj Com

Tax Benefits Nest Advisor 529 College Savings Plan

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

Does Your State Offer A 529 Plan Contribution Tax Deduction

Nj College Affordability Act What You Need To Know Access Wealth